Understanding flood zones in Citrus County helps buyers make informed and confident decisions before writing an offer. Flood zones can affect your insurance costs, your monthly payment, and the long term safety of the property. When you know how to check the status of a home, you can plan ahead and avoid surprises during the buying process in Citrus County and Marion County.

In the video below, I explain what flood zones are, how they’re determined, and why they matter when buying a home.

Flood zones can impact insurance requirements and costs

How to check flood zones in Citrus County

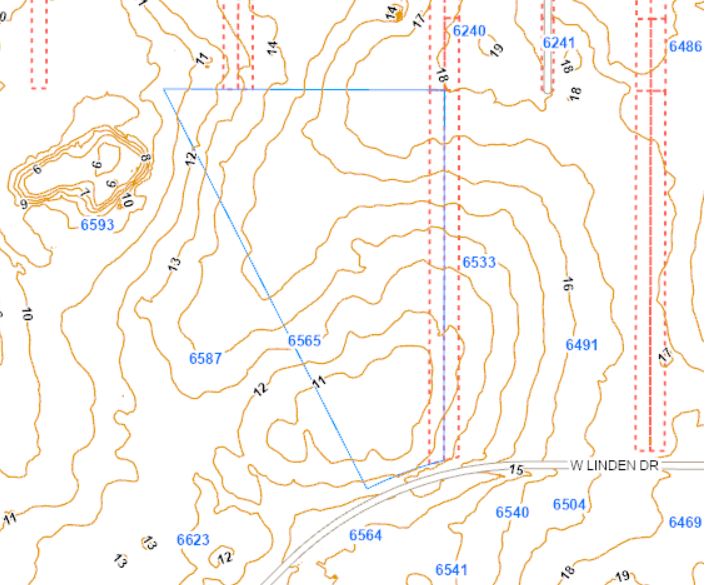

You can look up any address on the FEMA Flood Map Service Center. The map shows whether a home sits in a low risk zone, moderate risk zone, or a special flood hazard area. You can also ask your insurance agent or your real estate agent to verify the zone for you. Because of that, you can confirm the information before scheduling inspections.

What flood zones mean for local buyers

Not all zones require flood insurance. Low risk zones usually do not require a policy when using a traditional mortgage. Homes in zones AE, VE, or A may require flood insurance if you are financing the property. These zones are more common near Crystal River, Homosassa, Ozello, Inglis, and the Withlacoochee and Rainbow River areas.

How flood insurance affects your monthly payment

If a home requires flood insurance, it becomes part of your monthly escrow payment. Costs vary depending on elevation, age of the home, location, and coverage amount. Because of that, it is smart to get an early insurance quote so you know the full payment before making an offer.

Many buyers also ask how flood insurance and taxes affect their total monthly mortgage payment.

Why flood zone knowledge helps buyers stay confident

Understanding flood zones protects your long term investment. It also helps you compare homes more accurately. Many buyers in Citrus and Marion County check flood zones early so they can avoid delays once they find the right property.

Flood zones don’t have to be overwhelming when you understand how they work. If you have questions about flood zones or want help reviewing a specific property, I’m always happy to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link